How to Make Money with Cryptocurrency has emerged as a revolutionary financial asset, attracting investors and traders worldwide. The potential for high returns has piqued the interest of many looking to enhance their financial portfolio. In this article, we will explore various methods on how to make money with cryptocurrency, equipping you with the knowledge necessary to navigate this dynamic market.

10 Ways To How to Make Money with Cryptocurrency

1. Long-Term Investing

Long-term investing in cryptocurrency involves purchasing coins with the intention of holding them for several months or years. The strategy is based on the belief that, over time, the value of these assets will appreciate significantly.

Benefits of Long-Term Holding:

Key Strategies:

2. Bitcoin Mining

Bitcoin mining is the process of verifying transactions and adding them to the blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, they receive newly minted bitcoins as rewards.

Understanding Mining:

Profitability Factors:

3. Trade Cryptocurrency CFDs

Contracts for Difference (CFDs) enable traders to speculate on the price movement of cryptocurrencies without owning the underlying asset.

How CFDs Work:

Risks and Advantages:

4. Day Trading

Day trading involves buying and selling cryptocurrencies within the same trading day to profit from short-term price movements. This strategy requires significant market knowledge and quick decision-making.

Successful Day Trading Tips:

Psychological Discipline:

5. Arbitrage

Arbitrage is a trading strategy that takes advantage of price discrepancies for the same cryptocurrency on different exchanges.

How to Execute Arbitrage:

Market Knowledge:

6. Cryptocurrency Faucet

Cryptocurrency faucets are websites that dispense small amounts of cryptocurrencies in exchange for completing simple tasks, such as viewing ads or playing games.

How Faucets Work:

Types of Tasks:

Read this YSense Survey Review to learn how you can earn money by completing simple surveys online. Discover its features, benefits, and whether it’s worth your time and effort.

7. ICO (Initial Coin Offering)

ICOs are fundraising events where new cryptocurrencies are sold to investors. They are similar to initial public offerings (IPOs) in traditional finance but come with their own risks and rewards.

Understanding ICOs:

Risks and Rewards:

8. Crypto Gaming

The rise of blockchain-based games allows players to earn cryptocurrency through gameplay. Games often reward players with tokens that can be traded on exchanges.

Types of Crypto Games:

Earning Mechanisms:

9. Be a Blockchain Developer

As the demand for blockchain technology continues to grow, there’s an increasing need for skilled developers in this field.

Skills Development:

You must read this article How to Make $10 a Day Online with easy methods like surveys, freelancing, and affiliate marketing. Simple strategies to start earning daily from the comfort of home.

Job Market:

10. Crypto Affiliate

Affiliate marketing in the cryptocurrency sector allows you to earn commissions by promoting crypto-related products, services, or exchanges.

How It Works:

Choosing the Right Program:

How to Make Money with Cryptocurrency and Tax Accounting: Rules and Regulations

Understanding how cryptocurrency is taxed is crucial for anyone looking to profit from digital currencies.

Tax Treatment:

Record-Keeping:

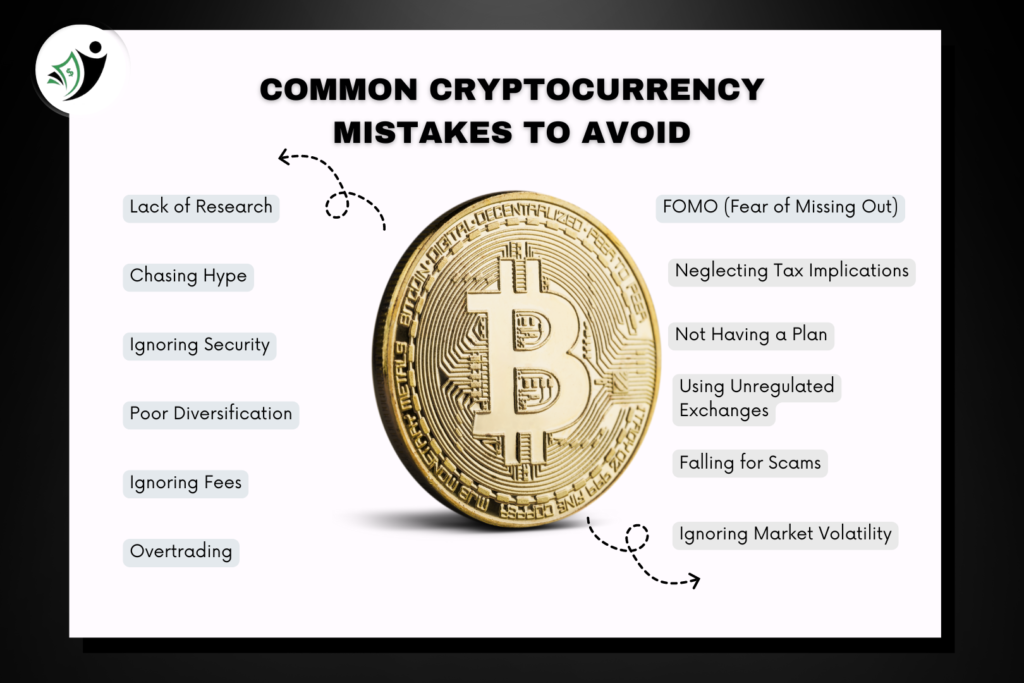

Common How to Make Money with Cryptocurrency Mistakes to Avoid

Navigating the cryptocurrency market can be challenging, especially for beginners. Here are some common pitfalls to avoid:

1. Investing Without Proper Research

One of the biggest mistakes is investing in a cryptocurrency just because it’s trending or someone recommended it. Always do your own research (DYOR) before putting money into any crypto project. Understand the technology, use case, team behind it, and market potential before making any decision.

Learn skills to make money from home like freelancing, digital marketing, content creation, or online tutoring. Master these in-demand skills to unlock remote income opportunities.

2. Falling for FOMO (Fear of Missing Out)

FOMO can lead to impulsive decisions. When the market is skyrocketing, many people buy in fear of missing out on potential gains, only to see the price drop soon after. Avoid rushing into trades; wait for the right time, and focus on long-term strategies rather than chasing quick profits.

3. Not Using Proper Security Measures

Many beginners fail to prioritize the security of their crypto holdings. Always use hardware wallets or secure digital wallets to store your assets. Enable two-factor authentication (2FA) on exchanges, and never share your private keys or passwords with anyone.

4. Ignoring Market Volatility

Cryptocurrency prices are extremely volatile, and new investors often panic when prices drop. It’s important to stay calm and avoid emotional decisions. Instead of panic selling during market dips, focus on long-term strategies like HODLing or dollar-cost averaging (DCA).

5. Over-investing More Than You Can Afford to Lose

Cryptocurrency can be lucrative, but it’s also risky. Never invest more money than you’re willing to lose. Many people fall into the trap of going all-in with their savings, hoping for massive returns, only to face financial losses when the market fluctuates.

6. Neglecting to Diversify

Relying solely on one cryptocurrency for all your investment is a risky strategy. Diversifying your portfolio by investing in multiple coins can help reduce risks. Established coins like Bitcoin and Ethereum are safer bets, but you can also include smaller altcoins for potential growth.

FAQ Of How to Make Money with Cryptocurrency

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency secured by cryptography. It operates on decentralized networks using blockchain technology, which ensures security and transparency.

Can You Make Money with Bitcoin?

Absolutely! Investing in Bitcoin can yield high returns, but it also comes with risks. Understanding market trends and conducting thorough research is essential for success.

How to Start Making Money with Crypto?

To begin, choose a reliable exchange, create an account, and explore different earning methods, such as trading or long-term investing. Educate yourself continuously to make informed decisions.

How To Trade Cryptocurrency On Mitrade?

To trade cryptocurrency on Mitrade, create an account, deposit funds, and familiarize yourself with the trading interface. Utilize market analysis and stay updated on trends.

What Hinders Beginners from Making Income from Crypto?

Beginners often face barriers such as lack of knowledge, emotional decision-making, and market volatility. Focusing on education and developing a disciplined approach can help overcome these challenges.

Can A Beginner Make Money Trading In Cryptocurrency?

Yes, beginners can make money trading cryptocurrencies, but success requires dedication, education, and a clear understanding of market dynamics.

What are the best ways to make money with cryptocurrency?

You can make money with cryptocurrency through various methods such as trading, investing in coins for the long term (HODLing), staking, mining, earning interest on your holdings, and participating in Initial Coin Offerings (ICOs). Each method carries different levels of risk and potential reward.

Is cryptocurrency trading profitable for beginners?

Yes, cryptocurrency trading can be profitable for beginners, but it also carries significant risks due to the volatility of the market. It’s important to start with small amounts, use strategies like dollar-cost averaging, and do extensive research before diving into trading.

Can I earn passive income with cryptocurrency?

Yes, you can earn passive income by staking your cryptocurrencies, lending them out, or using platforms that offer interest for holding digital assets. These options allow you to earn without active trading, but they come with some risk, so it’s important to choose reliable platforms.

What is the safest way to make money with cryptocurrency?

The safest way to make money with cryptocurrency is long-term investing or HODLing. Buy established coins like Bitcoin or Ethereum and hold onto them for years, as they tend to appreciate over time. Always use secure wallets and ensure your investments are well-researched.

How much do I need to start investing in cryptocurrency?

You can start investing in cryptocurrency with as little as a few dollars, depending on the exchange platform you’re using. It’s recommended to start with a small amount, especially if you’re a beginner, and only invest what you can afford to lose.

Are there any risks involved in making money with cryptocurrency?

Yes, the cryptocurrency market is highly volatile, and you could lose some or all of your investment. Risks include price fluctuations, hacking, scams, and regulatory changes. It’s important to research, diversify your investments, and use secure platforms to mitigate these risks.

Conclusion Of How to Make Money with Cryptocurrency

How to Make Money with Cryptocurrency we explored several ways to make money with cryptocurrency, from long-term investing and Bitcoin mining to day trading, arbitrage, and engaging with crypto faucets or gaming platforms. We also touched on the importance of understanding tax regulations, avoiding common pitfalls, and the growing demand for blockchain developers.

Before diving into the world of how to make money with cryptocurrency, it’s essential to research each method and understand the risks involved thoroughly. Cryptocurrency markets can be volatile, and staying informed will help you make smarter investment decisions.

The potential for earning money with cryptocurrency is significant, but it requires patience, knowledge, and adaptability. By exploring different avenues and staying updated on the latest trends, you can navigate the world of cryptocurrency and maximize your earning potential.