What are Mutual Funds?

How to Make Money from Mutual Funds is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. Each investor owns a portion of the mutual fund, which is referred to as “units.” The value of these units fluctuates with the performance of the investments held by the fund.

Unlike investing directly in stocks or bonds, mutual funds allow investors to spread their money across a wide range of assets, reducing the risk that comes from putting all their eggs in one basket. This diversification is one of the biggest advantages of mutual funds.

Why Mutual Funds?

Mutual funds are ideal for individuals who do not have the time, knowledge, or resources to analyze individual securities. Fund managers take care of this process, making investment decisions based on research and market trends.

For healthcare professionals, mutual funds offer a way to grow wealth steadily while focusing on their careers. You don’t need to actively manage your investments; a fund manager does that for you. Moreover, mutual funds are flexible. You can choose to invest in equity (stocks), debt (bonds), or a combination of both, depending on your financial goals and risk tolerance.

Learn more about What Is Mutual Fund Investment and how they work here.

Role in Financial Planning

Mutual funds play a critical role in financial planning, especially for long-term goals such as retirement, buying a house, or funding your children’s education. They offer a disciplined approach to investing and provide a range of options tailored to different financial needs. For example, equity mutual funds can help grow wealth significantly over the long term, while debt funds provide steady returns for conservative investors.

By investing regularly in mutual funds, you can take advantage of the power of compounding, where your returns generate more returns over time.

How To Make Money From Mutual Funds

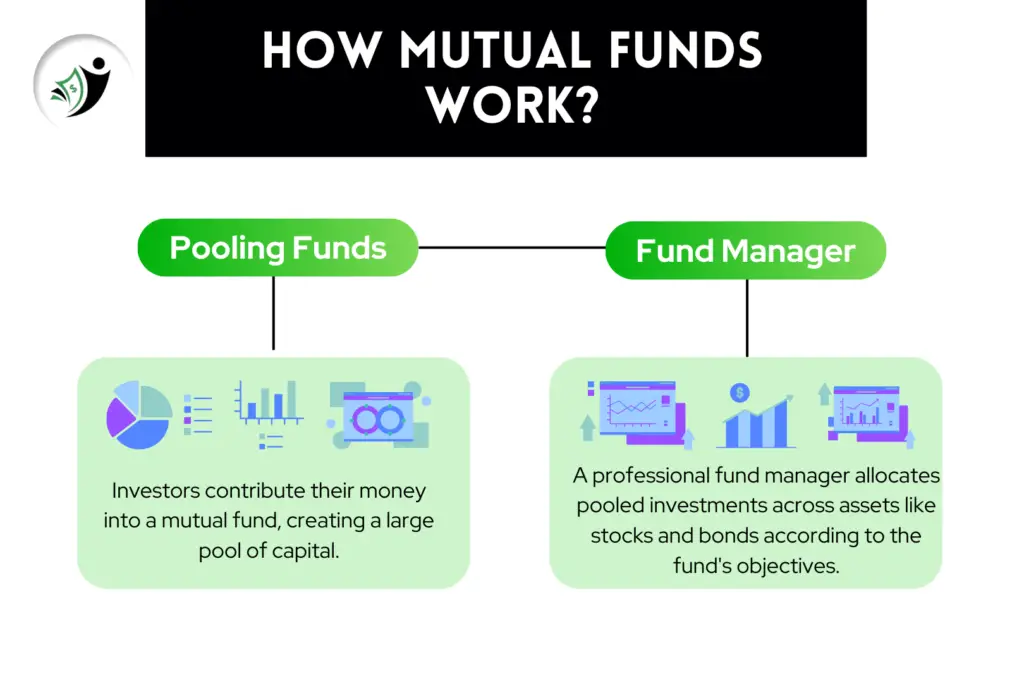

Pooling of Funds

Mutual funds work by pooling money from several investors. Each investor buys units of the fund, and the pooled money is used to invest in various assets. This pooling allows individual investors to access a diversified portfolio, something that would be difficult and expensive to achieve independently.

For instance, if you invest ₹10,000 in an equity mutual fund, your money is combined with that of other investors. The fund manager then uses this collective amount to purchase shares in multiple companies, which means you benefit from the performance of all the companies in the portfolio rather than just one.

How to Make Money with Cryptocurrency Explore various strategies and tips to start making money with cryptocurrency here.

Fund Managers

The key players in mutual funds are the professional fund managers who make all the investment decisions. These managers have in-depth knowledge of the financial markets and apply strategies to maximize returns while managing risk. They continuously analyze market trends, economic data, and company performance to make informed decisions about where to allocate the fund’s money.

For example, if a fund manager sees growth potential in the healthcare sector, they may allocate more of the fund’s capital into healthcare stocks.

Types of how to make money from mutual funds

There are different types of mutual funds, each catering to different investment goals and risk levels:

Ways to How To Make Money From Mutual Funds

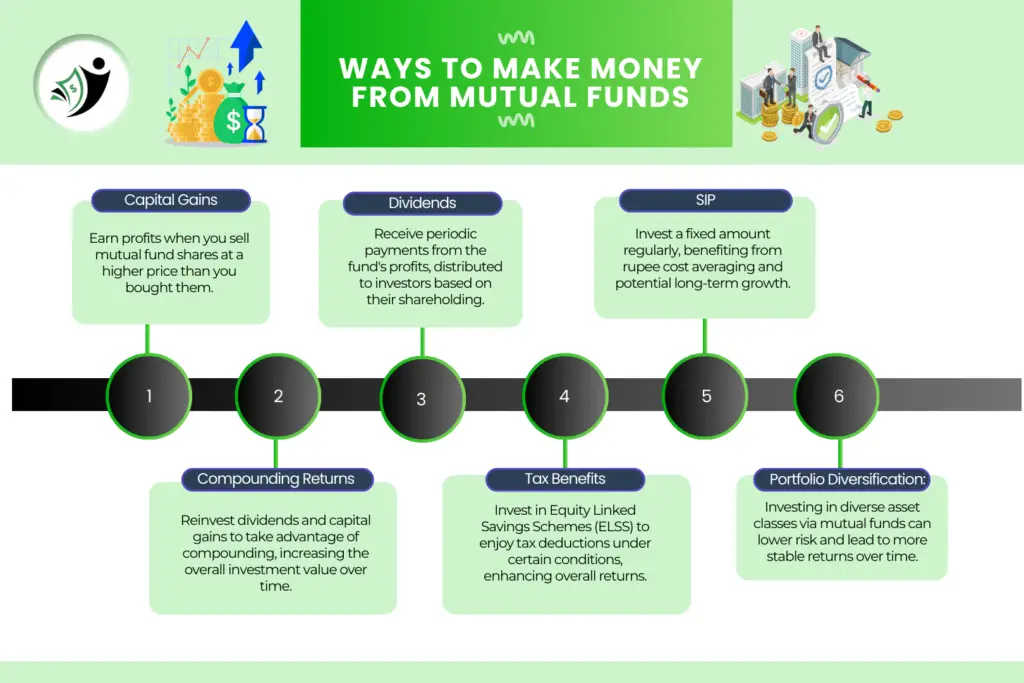

Capital Appreciation

Capital appreciation is the increase in the value of your mutual fund units over time. When the underlying assets of the mutual fund (such as stocks in an equity fund) perform well, the NAV (Net Asset Value) of the fund increases. This means you can sell your units for more than you paid for them, resulting in a profit.

For example, if you bought units of an equity mutual fund at ₹50 per unit and the NAV rises to ₹70 per unit, you’ve made a profit of ₹20 per unit if you decide to sell.

Dividends

Some mutual funds invest in dividend-paying stocks or bonds and distribute a portion of these earnings to investors in the form of dividends. This is an additional source of income for investors. You can either reinvest the dividends to buy more units or receive the payouts as cash.

For instance, if a debt mutual fund invests in bonds that pay interest, the interest is passed on to investors in the form of dividends. These dividends can be an attractive option for those seeking regular income from their investments.

Interest Income

Debt mutual funds primarily invest in bonds and other fixed-income securities. These bonds pay interest, which is distributed to the mutual fund’s investors as part of the fund’s income. Investors seeking stable, regular income often prefer debt funds for this reason.

Interest income is typically steady and reliable, making debt funds a popular choice for conservative investors who want to avoid the volatility of the stock market.

Types of How To Make Money From Mutual Funds And Their Profit Potential

Equity Mutual Funds

Equity mutual funds invest primarily in stocks, offering higher growth potential, especially over the long term. While they are riskier compared to other types of funds, the potential for capital appreciation is also greater. For investors looking to understand how to make money from mutual funds, equity funds can be a strong option. They are best suited for individuals with a high-risk tolerance and a long investment horizon. For example, an equity fund might invest in companies in the technology sector, which could provide significant growth opportunities over time.

Debt Mutual Funds

In contrast, debt mutual funds invest in bonds and other fixed-income securities, providing stability and regular interest income. These funds are ideal for conservative investors who prefer less risk.

The returns from debt funds are lower compared to equity funds, but they are generally more predictable. For those exploring how to make money from mutual funds, debt funds offer a safer alternative, particularly useful for investors who are nearing retirement and prefer steady income rather than the volatility of the stock market.

Hybrid Mutual Funds

Hybrid mutual funds provide a balance between risk and return by investing in a mix of equity and debt securities. This strategy allows investors to benefit from the growth potential of stocks while also enjoying the stability of bonds. For those seeking to understand how to make money from mutual funds, hybrid funds can be an attractive option as they offer moderate risk and the potential for better returns than traditional debt investments.

Hybrid funds are suitable for investors looking for a moderate risk-return balance. They provide an opportunity for those who want to participate in stock market growth but are not comfortable with the full risk exposure of equity funds. By investing in hybrid mutual funds, you can explore how to make money from mutual funds without taking on the heightened volatility associated with pure equity investments.

Key Factors Influencing Returns How To Make Money From Mutual Funds

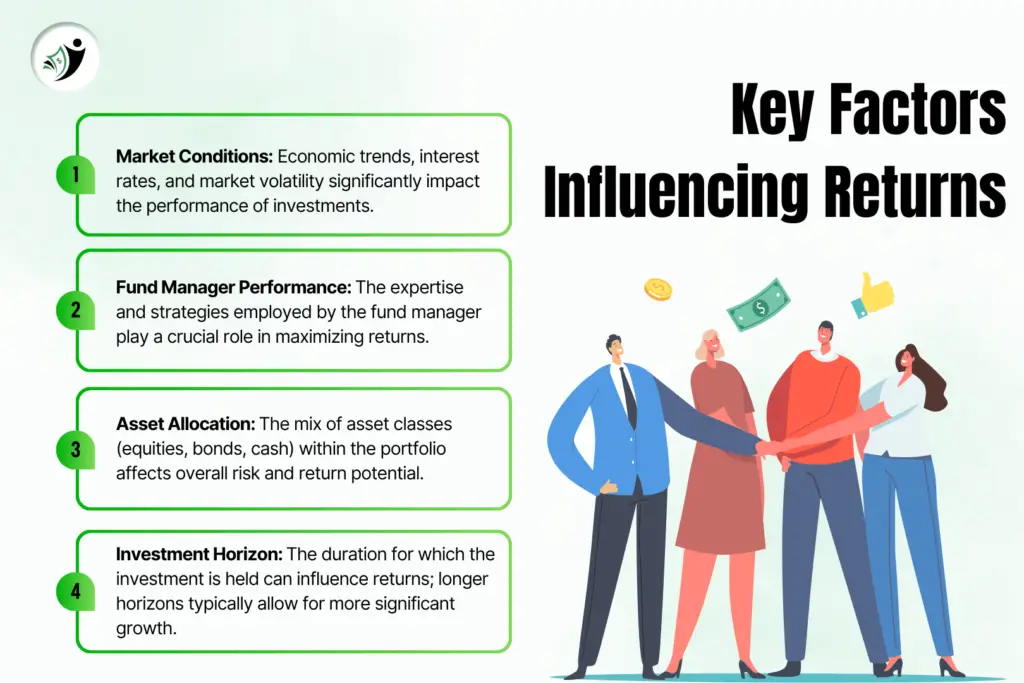

Market Performance

The returns of equity mutual funds are highly dependent on stock market performance. In a bull market (when stock prices are rising), equity funds tend to deliver strong returns, making it easier to understand how to make money from mutual funds. However, during a bear market (when stock prices are falling), the value of equity mutual funds can decline, highlighting the inherent risks involved in this investment approach.

On the other hand, debt funds are less affected by market fluctuations but are influenced by interest rate changes. When interest rates rise, the value of bonds falls, which can impact debt fund returns. This aspect is crucial for investors to consider when determining how to make money from mutual funds, as choosing the right fund type can significantly influence overall returns.

Fund Manager’s Expertise

The success of a mutual fund is often linked to the expertise of its fund manager. A skilled fund manager can identify profitable investment opportunities and effectively manage risk, which plays a critical role in learning how to make money from mutual funds. Conversely, a less experienced manager may struggle to deliver consistent returns, impacting the fund’s performance.

For example, a fund manager who correctly predicts a sector’s growth can significantly boost the performance of the fund, leading to higher returns for investors. Thus, understanding the fund manager’s track record can provide valuable insights into how to make money from mutual funds and help investors make more informed choices.

In summary, being aware of market performance and the expertise of fund managers is essential for anyone looking to maximize their investment potential. By considering these key factors, you can enhance your strategy on how to make money from mutual funds effectively.

Expense Ratio

The expense ratio is the annual fee that mutual funds charge for managing your investment. A lower expense ratio means more of your money stays invested, which can lead to better long-term returns. High expense ratios can eat into your profits, so it’s essential to choose funds with competitive fees.

Investment Horizon

Your investment horizon refers to the length of time you plan to stay invested in a mutual fund. The longer you remain invested, the more likely you are to benefit from the power of compounding. Mutual funds, especially equity funds, tend to deliver better results over a long-term horizon compared to short-term investments.

Strategies to Maximize Earnings From How To Make Money From Mutual Funds

Systematic Investment Plan (SIP)

- What is SIP?: A method where you invest a fixed amount regularly (monthly or quarterly) in a mutual fund.

- Benefits:

- Power of Compounding: By staying invested for the long term, returns accumulate on both the principal and previous earnings.

- Rupee Cost Averaging: Investing fixed amounts helps buy more units when prices are low and fewer units when prices are high, reducing the overall cost of your investment.

Lump-Sum Investment

- What is Lump-Sum?: Investing a large amount at once.

- When to Use: Ideal when market conditions are favorable, and you have a large sum available for investment. However, it requires careful market timing.

Diversification

Investing across various mutual funds (equity, debt, hybrid) reduces risk. Diversification helps cushion the impact of poor performance in any single asset class, balancing out overall returns.

Portfolio Rebalancing

Regularly reviewing and adjusting your portfolio is essential for aligning your investments with changing financial goals or market conditions. This ensures that your asset allocation remains consistent with your risk tolerance and investment strategy.

Tax Implications of How To Make Money From Mutual Funds Earnings

Capital Gains Tax

Dividend Distribution Tax (DDT)

Dividend income from mutual funds is taxable in the hands of investors, based on their applicable income tax slab rate.

Indexation Benefit for Debt Funds

Indexation allows adjusting the purchase price for inflation, reducing the overall tax liability on long-term gains from debt funds. This can enhance net returns for long-term investors.

Risks Involved and How to Mitigate Them

Market Risk

Equity funds are susceptible to market volatility, and their value can fluctuate based on market conditions.

- Mitigation: Stay invested for the long term and diversify across different sectors and geographies to reduce risk.

Credit Risk in Debt Funds

Debt funds are exposed to credit risk, where bond issuers may default on repayments.

- Mitigation: Invest in debt funds that hold high-rated, government-backed securities to minimize credit risk.

Liquidity Risk

Some mutual funds, especially closed-ended funds, may have lower liquidity, meaning you might not be able to redeem your units quickly.

- Mitigation: Consider investing in open-ended funds or those with shorter lock-in periods for better liquidity.

How To Make Money From Mutual Funds Investment for Different Financial Goals

Retirement Planning

Long-term equity funds or balanced funds can help build a substantial retirement corpus through compounding. Starting early and investing regularly can significantly enhance retirement savings.

Child’s Education

A mix of equity and debt funds can ensure steady growth for your child’s education fund, adjusted for inflation. Investing in growth-oriented funds during their early years can provide a strong financial foundation.

Short-Term Goals

Liquid or ultra-short-term debt funds are suitable for emergency savings or short-term goals like vacations or home renovations. These funds offer better returns than traditional savings accounts with lower risk.

Skills To Learn To Make Money From Home Unlock top skills you can master to start earning from the comfort of your home!

FAQs Of How To Make Money From Mutual Funds

What is the best way to make money from mutual funds?

You can make money from mutual funds through capital appreciation (the rise in the value of your investment) or by earning dividends or interest income. To maximize your returns, invest in funds that match your financial goals, diversify your portfolio, and stay invested long-term to benefit from compounding.

How much should I invest in mutual funds to make a profit?

There is no fixed amount to start with, but it’s advisable to invest based on your financial goals, risk tolerance, and time horizon. You can start small with systematic investment plans (SIPs) and gradually increase your investment to grow wealth over time.

How long should I stay invested in mutual funds to make money?

The longer you stay invested in mutual funds, the higher your chances of earning significant returns. Generally, mutual funds are considered long-term investments, and staying invested for 5-10 years or more can help you achieve higher returns due to compounding.

Are mutual funds safe for making money?

Mutual funds come with a certain level of risk, as they are subject to market fluctuations. However, diversifying your investment across different types of funds and asset classes can reduce risk. Debt funds are relatively safer, while equity funds offer higher returns but with higher risk.

Can I lose money in mutual funds?

Yes, mutual funds are subject to market risk, and you can experience losses if the market performs poorly or if you redeem your investment during a downturn. However, by investing for the long term and staying patient, you can mitigate these risks and increase your chances of earning profits.

How can I choose the right mutual fund to make money?

To choose the right mutual fund, consider factors like your financial goals, risk appetite, investment horizon, and the fund’s historical performance. You can also consult a financial advisor or use online tools to compare funds before making a decision.

Conclusion Of How To Make Money From Mutual Funds

how to make money from mutual funds is a question many investors seek to answer. Investing in mutual funds provides various avenues for generating income, including capital appreciation, dividends, and interest income. By holding onto your investments for the long term, you can maximize the benefits of compounding, which significantly enhances your returns and helps mitigate the effects of short-term market fluctuations.

Understanding how to make money from mutual funds goes beyond just selecting the right fund; it involves a commitment to responsible investing. This means being aware of the risks associated with your investments, regularly monitoring your portfolio’s performance, and making informed decisions based on market trends and your financial goals.

Moreover, it’s crucial to align your investment strategy with your risk tolerance. By doing so, you will be better equipped to handle market volatility and make adjustments as needed. In this way, how to make money from mutual funds becomes a strategic approach to building wealth rather than a speculative gamble.

In essence, mutual funds can serve as a powerful tool for wealth creation if approached with the right mindset, strategies, and risk management techniques. Therefore, taking the time to educate yourself on how to make money from mutual funds and developing a solid investment plan can set you on the path to financial success and stability.